Yes, Even Smart People Still Overpay for These Everyday Expenses

(And How SaveClub Quietly Fixes It — and Opens the Door to a Smarter 2026)

You’re not reckless with money.

You compare prices.

You look for sales.

You probably tell yourself, “I’m doing okay — at least I’m not wasting money.”

And you’re right… mostly.

But even smart, careful people overpay every single week — not because they’re careless, but because the savings are hidden, fragmented, and inconvenient to chase down.

That’s where the real money leaks happen.

“Smart people don’t overspend on purpose.

They just don’t always see where money leaks.”

Groceries & Household Essentials: Saving Doesn’t Stop at the Register

You shop sales. You clip digital coupons. Maybe you even switch stores when the deals are good.

But here’s the problem: most grocery savings stop the moment you pay.

With SaveClub, members earn cash back after they shop, even at stores they already use. Groceries, pantry items, and household essentials quietly generate money back — month after month.

No coupon stacking gymnastics. No brand-hopping fatigue. Just savings that accumulate because groceries are non-optional anyway.

Dining Out: Convenience Is Expensive (But It Doesn’t Have to Be)

Even “just grabbing something quick” adds up faster than most people realize.

SaveClub offers cash back at restaurants and dining partners, meaning meals you’d buy anyway start paying you back. Date night, lunch out, family meals — all count.

It’s not about eating out more.

It’s about not losing money every time you do.

“SaveClub doesn’t change your lifestyle.

It changes the math behind it.”

Exclusive Member Deals: Where the Deep Discounts Live

This is where many people are genuinely surprised.

SaveClub doesn’t just offer cash back — it also provides exclusive, member-only pricing that simply isn’t available elsewhere.

Examples include:

- AveDerm Relief — available to SaveClub members at up to 70% off retail

- Soosul Korean Skincare Bundles — over 50% off standard pricing

- Stay Well Copper products — SaveClub members receive up to 50% off through exclusive deals

These aren’t clearance items or limited-time gimmicks. They’re negotiated, members-only prices — often the lowest price available anywhere.

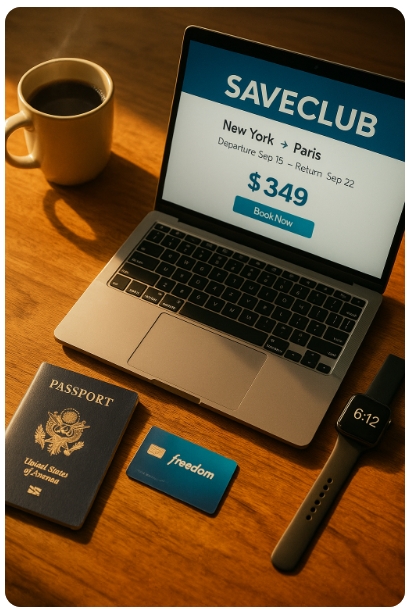

Travel & Hotels: Where Bigger Savings Hide in Plain Sight

Travel is one of the sneakiest budget busters because the prices feel normal.

SaveClub’s travel benefits can include:

- Hotel discounts

- Vacation savings

- Cash back on bookings

For families or anyone who travels even once or twice a year, this is often where some of the largest single savings show up.

Same trips. Better outcomes.

Prescriptions, Health & Wellness: Small Costs That Add Up

Health-related expenses rarely feel dramatic in the moment — but over time, they accumulate quietly.

SaveClub provides discounts on prescriptions and wellness products, helping reduce out-of-pocket costs without switching doctors, pharmacies, or insurance plans.

Less friction. More breathing room.

Bills You Already Pay: Quietly Reduced

One of the most overlooked benefits of SaveClub is its ability to help members lower existing monthly bills.

That can include:

- Electric bills

- Cell phone plans

- Cable and internet services

Instead of spending hours on hold or negotiating yourself, members can access services designed to help secure better rates on bills they already pay.

Same providers. Lower costs.

“You don’t need better discipline —

you need better positioning.”

A 2026 Financial Goal That Fits Real Life

As we look toward 2026, many people are feeling the pressure.

Prices are higher.

Budgets are tighter.

And “just cutting back” doesn’t go as far as it used to.

That’s why a smarter New Year goal isn’t just about spending less — it’s about earning smarter.

SaveClub gives members the option to turn everyday savings into an income opportunity — especially valuable during financially challenging times.

Not by pushing products.

Not by chasing trends.

But by sharing something people already need: lower costs.

🔔 Your 2026 Money Reset Starts Here

As prices rise and budgets tighten, the smartest financial move for 2026 isn’t drastic change — it’s better positioning.

- ✔ Save on everyday spending

- ✔ Access exclusive member-only deals

- ✔ Lower monthly bills you already pay

- ✔ Optionally earn by helping others do the same

Earning Potential Without the Usual Side-Hustle Stress

Traditional side hustles often require:

- Extra hours

- New skills

- Upfront investment

- Burnout-level effort

SaveClub’s earning model is different.

Many members start simply by:

- Helping a friend lower a bill

- Sharing exclusive member deals

- Showing someone how to save on everyday spending

Over time, that can mean:

- Offsetting monthly expenses

- Covering a utility bill

- Paying for groceries

- Creating a financial buffer during tight months

Not hype.

Not “get rich quick.”

Just real relief.

“Extra income doesn’t have to be dramatic.

It just has to be dependable.”

The Power of Choice Going Into 2026

Not everyone joins SaveClub to earn.

Some join purely to save.

Others explore earning later.

Some do both.

That flexibility matters — especially heading into a new year when financial confidence may be shaky.

SaveClub doesn’t force a path.

It creates options.

Final Thought

Smart people don’t waste money on purpose.

They just don’t always see where it’s leaking.

SaveClub helps close those leaks — and for those who want it, opens the door to earning in a way that fits real life.

As a 2026 goal, that’s not flashy.

It’s sustainable.

And right now, sustainability beats everything.

Same spending. Better outcomes. Smarter year ahead.

👉 Explore SaveClub and see what’s possible for you in 2026.

Leave a Reply