Every year it happens like clockwork.

December feels magical — twinkling lights, festive meals, gift exchanges, parties, travel, and just a little extra spending “because it’s Christmas.” 🎄

Then January arrives… and suddenly the magic comes with a minimum payment.

Credit card statements land in the inboxes.

Buy-now-pay-later balances wake up.

And that “I’ll deal with it later” moment shows up right on schedule.

If this sounds familiar, you’re not alone — and you’re definitely not broken.

Why Holiday Spending Spirals So Easily

Holiday overspending usually isn’t about irresponsibility. It’s about pressure and emotion.

🎁 Gifts — Nobody wants to be the one who gives “less.”

👕 Clothing & accessories — Parties, family photos, events… it adds up fast.

🍽️ Meals & gatherings — Hosting costs more than we realize.

✈️ Travel — Even short trips can blow a budget wide open.

🛍️ Impulse shopping — Sales everywhere, urgency everywhere.

In December, spending feels temporary.

In January, the payments feel permanent.

The January Reality Check

Once the decorations come down, the bills stay up.

Many people realize:

Monthly budgets are suddenly tight

Savings took a hit (or vanished)

Catching up feels overwhelming

Stress replaces celebration

- bills are overwhelming

And hers’ the worst part?

Most people promise themselves, “Next year it will be different” — without changing anything.

That’s how the cycle repeats.

Breaking the Cycle: Earn and Save at the Same Time

This is where SaveClub becomes more than just another “program.”

This is where SaveClub becomes more than just another “program.”

SaveClub attacks the problem from both sides:

💰 1. Help Offset Those January Bills

SaveClub allows members to earn income simply by sharing a platform people already use — saving money on everyday purchases.

That extra income can:

Help cover holiday debt payments

Reduce financial pressure

Give breathing room while you regroup

No hype. No inventory. Just leverage.

🛒 2. Save on Spending You’re Already Doing

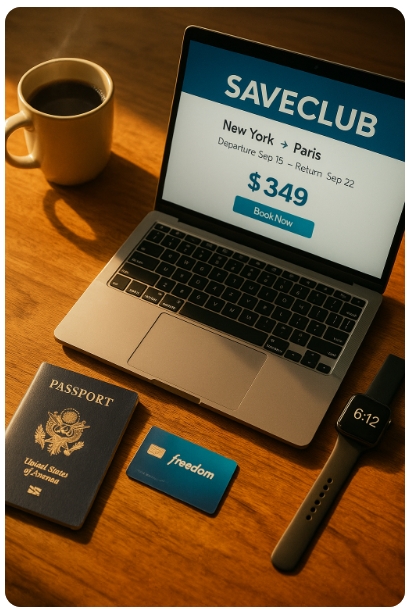

Groceries. Gas. Dining. Travel. Online shopping.

SaveClub provides real savings on real expenses, which means:

Less money leaking out each month

Smarter spending habits without sacrifice

Future holidays become manageable instead of stressful

Saving money isn’t exciting — until you actually see it working.

From Recovery to Control

The goal isn’t to never enjoy the holidays again.

The goal is to enjoy them without regret.

Imagine:

Entering next December with confidence

Knowing January won’t hurt

Having income and savings working in the background

Finally feeling ahead instead of behind

That’s not wishful thinking. That’s a system.

🎯 Here’s Your Target: Start Turning the Tables Now

January doesn’t have to be damage control.

January doesn’t have to be a month of regret and financial stress. It can be the turning point where smarter habits begin. By combining small, consistent savings with an opportunity to earn extra income, you can turn holiday overspending into a lesson instead of a setback. The key is starting now—before another year slips by repeating the same costly cycle.

If you’re tired of the holiday spending hangover and want a smarter way forward, it’s time to take a serious look at SaveClub.

👉 Start earning. Start saving. Start changing the pattern.

👉 Explore SaveClub today and put your money to work for you — not against you.

Because next January should feel a lot lighter than this one.

Leave a Reply